Decades of economic growth coupled with ongoing military modernization campaigns have enabled China to emerge as a major player in the global arms trade. For years, Beijing imported several times more conventional weapons than it sold overseas, but for most of the last decade, China has been a net arms exporter. According to data from the Stockholm International Peace Research Institute (SIPRI), China was the fifth largest arms exporter in the world from 2010 to 2020 – behind the United States, Russia, France, and Germany.

SIPRI measures the international flow of arms in TIV (trend-indicator values) – a unique measurement developed by SIPRI based on estimations of production cost for various weapons. TIVs do not directly measure the financial value of an arms sale in a specific currency, but they allow for comparisons between countries and across time.

From 2010 to 2020, China exported nearly 16.6 billion TIV worth of conventional weapons across the globe. The lion’s share – around 77.3 percent – went to Asia. An additional 19.1 percent flowed into Africa, and the remaining 3.6 percent went to other parts of the world.

The value of China’s total arms exports varies significantly from year to year, but during the 2010-2020 period, Chinese arms sales averaged 1.5 billion TIV per year. Notably, China’s exports in 2020 dropped to just 759 million TIV – the lowest level since 2008. The sharp fall in Chinese exports accompanied a broader 16 percent decrease in global arms sales in 2020 that was in part due to the economic fallout of the Covid-19 pandemic.

Although China has established itself as an arms export leader, the overall value of its trade still pales in comparison to that of the United States and Russia. The US exported a massive 105 billion TIV from 2010 to 2020 – more than six times the Chinese total. Russia exported 70.5 billion TIV, or about four times as much as China.

Arming its Neighbors

Most of Beijing’s arms exports are sold to countries close to home. Despite low levels of arms exports throughout the mid-1990s and into the mid-2000s, most of what China did export (82.8 percent) was shipped to countries across Asia. This trend has continued as China became increasingly prominent in the global arms trade. A combined 63.4 percent of China’s conventional weapons sales since 2010 found their way to Pakistan, Bangladesh, and Myanmar. Other Asian countries purchased an additional 13.9 percent of Chinese arms.

China’s combined arms sales to South and Southeast Asia grew from 847 million TIV in 2010 to nearly 1.6 billion TIV in 2013. Since 2014, annual sales have averaged just over 1 billion TIV. Despite the heavy concentration in these subregions, China lags other traditional arms exporters. The US exported 14.2 billion TIV worth of conventional weapons to the same subregions, with 71.3 of these exports going to India (4.2 billion TIV), Singapore (3.2 billion TIV) and Afghanistan (2.7 billion TIV).

Owing to their close military ties, China supplies Pakistan with the largest amount of arms of any other country. Growing cooperation between Beijing and Islamabad on counter-terrorism initiatives led sales to surge from 250 million TIV in 2008 to over 758 million TIV in 2009. Since 2010, sales to Pakistan have averaged 586.9 million TIV per year.

In March 2018, Beijing announced the sale of sophisticated optical tracking systems that could be used for nuclear missiles with multiple warheads. This announcement came just weeks after India successfully tested the Agni-V long-range ballistic missile in mid-January. Other purchases highlight close levels of collaboration between the Chinese and Pakistani militaries, such as the co-developed JF-17 aircraft and the Type 054AP frigate, which China is constructing for the Pakistani Navy. Chinese shipbuilder Hudong-Zhonghua already launched two of the Type 054APs in August 2020 and January 2021, and another two vessels are reportedly under construction. The four vessels are expected to be delivered to Pakistan in late 2021 or 2022.

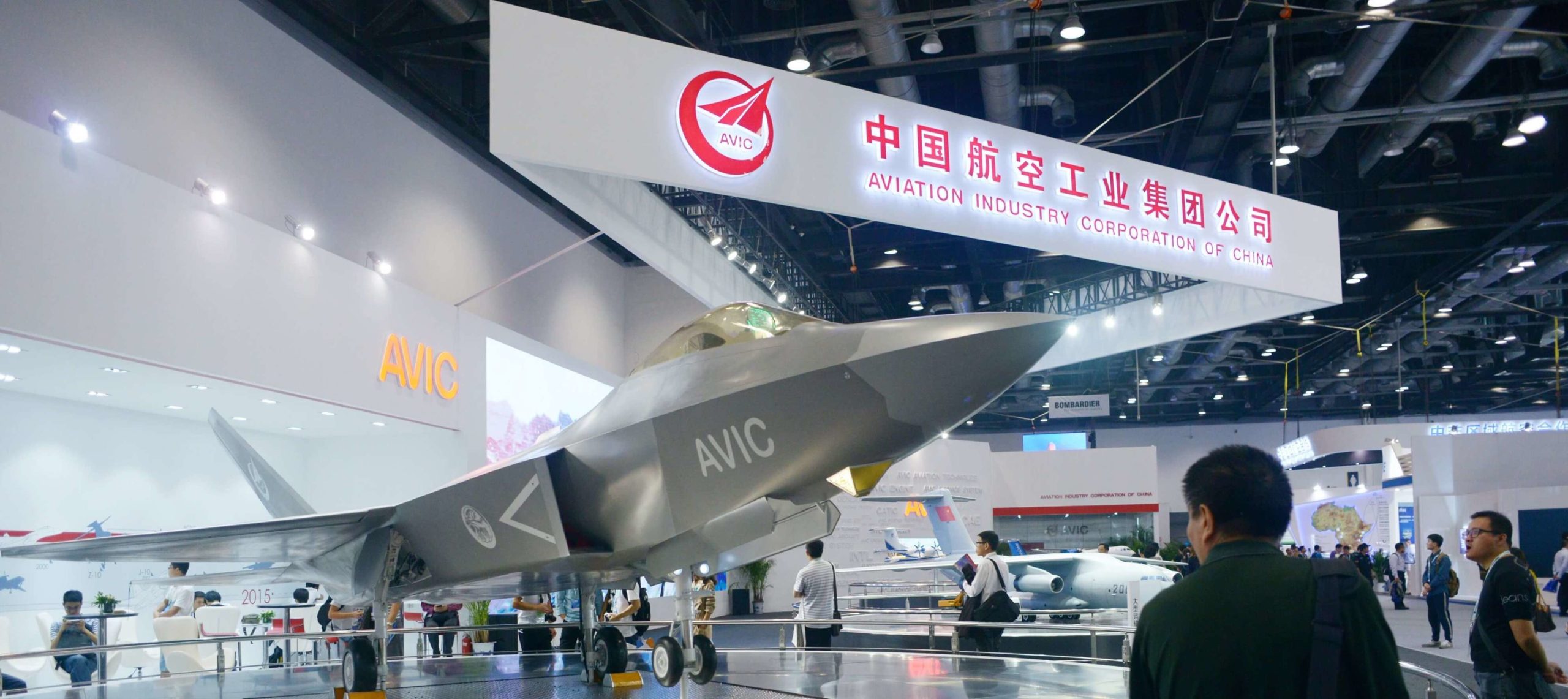

While China is only the fifth-largest arms exporter, its domestic arms industry is the second-largest in the world. Learn more about China’s military industrial base and what Beijing is doing to develop it.

Bangladesh is also a top purchaser of Chinese weapons. Between 2010 and 2020, China provided 2.6 billion TIV of weapons to the South Asian nation. This constitutes 73.6 percent of Bangladesh’s foreign military acquisitions over this period, making China the biggest supplier of arms to Dhaka. China supports these procurements through generous loans and competitive prices. Discounted acquisitions include the 2013 transfer of two used Type-035G Ming-class submarines to Bangladesh for just over $100 million each. Since 2006, China has also supplied Bangladesh with the majority of its small arms, totaling over 16,000 rifles and 4,100 pistols.

Myanmar is the third largest market for Chinese arms exports in Asia. Since the easing of sanctions against Myanmar in the early 2010s, it has ramped up its acquisition of foreign arms. This buying spree has enabled China to make considerable inroads. Since 2013, Myanmar has imported 970 million TIV in conventional weapons from China. Higher-ticket items include 17 JF-17 aircraft, 12 Chinese Rainbow UAVs, 2 Y-8 transport aircraft, 2 Type-43 Frigates, and 76 Type-92 armored vehicles. Notably, the Myanmar military was found to have deployed Chinese-made CH-3A tactical UAVs to observe protests that sprang up in the wake of the February 1, 2021 coup.

The Market for Chinese Arms in Africa

For most of the 1980s and 1990s, weapons sales to Africa represented less than 15 percent of China’s total arms exports. That number has grown somewhat as China has worked to expand its foothold in the region. Between 2010 and 2020, countries in Africa collectively purchased around 19.1 percent (3.2 billion TIV) of China’s overall arms exports. Northern African countries were the primary destination of Chinese weapons, constituting 49 percent of Chinese exports to the continent. An additional 19 percent flowed into East Africa, and the remaining 32 percent were divided among other areas of the continent.

This relatively wide market distribution is somewhat unusual for major arms traders. Of the 5.4 billion TIV of US arms exported to Africa over the last decade, roughly 87 percent was purchased by Egypt and Morocco alone. Similarly, Algeria and Egypt accounted for 84.3 percent of Russian arms sales in Africa over the same period. In terms of overall arms trade to the continent, Russia leads with 14.2 billion TIV in sales since 2010. The US tallied less than half of that at 5.4 billion TIV, while China sold just 3.2 billion TIV.

China lags more established arms suppliers largely due to quality issues. The US Department of Defense (DoD) notes that “quality deficiencies persist with some exported equipment, which is inhibiting China’s ability to expand its export markets.” That said, the smaller price tag of Chinese arms makes them attractive to many countries. The DoD notes that “Chinese arms are less expensive than those offered by the top international arms suppliers… [but still] have advanced capabilities.”

Chinese arms suppliers are actively working to strengthen their foothold in certain markets, such as Algeria. China’s exports to the North African country averaged 116 million TIV between 2010 and 2020, but jumped to 245 million TIV in 2015 and peaked at 496 million TIV in 2016. These procurements included three C-28A frigates, which were ordered by Algeria in 2012. Nevertheless, China’s overall arms exports to Africa have declined in recent years. Chinese arms sales to the region averaged 234 million TIV from 2016-2020, down almost 23 percent compared to the previous five-year period.

It is worth noting that Chinese weapons have reportedly been used in conflicts across Africa, including in the Democratic Republic of Congo, Côte d’Ivoire, Sudan, and Somalia. In July 2014, China North Industries Corporation delivered 100 guided missile systems, over 9,000 automatic rifles, and 24 million rounds of ammunition to the South Sudanese government, whose actions have been widely criticized by the international community.

China’s Modest Arms Trade with the Americas

Since 2010, Chinese arms sales to the Americas totaled 577 million TIV, peaking at 129 million TIV in 2015 and plummeting to 1 million TIV in 2018. Beijing sold less than 1 million TIV worth of weapons to the region in 2017, 2019, and 2020. Likewise, since 2010, Chinese conventional weapons made up just 2.2 percent of the combined North and South American arms import market, which is dominated by the United States (18.5 percent), Germany (11.1 percent), and Russia (10.1 percent).

Chinese arms exports in the Americas are concentrated in Venezuela, which attracted 85.8 percent of China’s regional weapons sales over the last decade. Nonetheless, from 2010 to 2020, China was only Venezuela’s number-two supplier of conventional weapons at 16.4 percent of the market share. Russia dominated, supplying Caracas with 59.6 percent of its arms imports.

| Top 5 Chinese Arms Export Destinations in the Americas, 2010-2020 | |||

|---|---|---|---|

| Overall Rank | Country | Value (Millions $) | % of Total Imports |

| 1 | Venezuela | 495 | 85.8 |

| 2 | Bolivia | 45 | 7.8 |

| 3 | Trinidad and Tobago | 16 | 2.8 |

| 4 | Peru | 13 | 2.3 |

| 5 | Ecuador | 8 | 1.4 |

| Source: SIPRI Arms Transfers Database | |||

Chinese weapon transfers to Venezuela did not begin in earnest until after 2006 when the United States placed an arms embargo against Venezuela for failing to cooperate with US-led anti-terrorism efforts. Since then, Caracas has found a ready partner in China as it has sought to upgrade its military in a cost-effective manner. Notable transactions include the sale of 18 K-8 trainer jets in 2010, 121 VN-4 armored vehicles in 2012, and an undisclosed number of C-802 anti-ship missiles in 2017. In May 2019, the Venezuelan National Guard reportedly deployed eight VN-4 armored vehicles against ongoing anti-government protests.

While China’s major conventional weapons sales in the region are limited, China is a substantial provider of small arms to North America. Prior to 2009, most of these procurements flowed into Canada, but in recent years Mexico has become a more significant market. According to some reports, Chinese weapons are increasingly finding their way into the hands of Mexican cartels. All told, however, China only supplies a fraction of both country’s foreign small arms acquisitions.

Arms Imports from Russia and Europe

Unlike most other regions, where China is a net exporter of arms, Europe presents a different story. More than 99 percent of China’s total arms imports (13.7 billion TIV) come from Europe, while it exports a paltry 26 million TIV of its own weapons to the continent. This trend is driven mostly by Russia, which supplies China with 66.6 percent of its foreign-made arms. France and Ukraine collectively supply an additional 22.7 percent.

Historically, Russian arms have poured over the border to China, but this trend is shifting. Russian arms sales to China averaged over 2 billion TIV per year from 2001 to 2010, reaching a peak of $3.1 billion in 2005. This figure dropped significantly, with China averaging just 853 million TIV worth of Russian imports per year between 2011 and 2020. As a result, China’s share of Russian arms exports declined from a high of 60.2 percent in 2005 to 18.7 percent in 2020.

This trend reflects China’s growing capability to domestically produce sophisticated weapon systems, which partly stems from heavy investments in research and development (R&D). China is the world’s second highest spender on R&D and is quickly closing the gap with the United States. However, China’s growing independence has also been supported by the successful reverse engineering of existing foreign technology. For instance, in the 1990s China entered into a co-production deal with Russia to develop Shenyang J-11 fighters based on the design of Russian Su-27s.1 Additionally, Chinese HQ-9 surface-to-air missiles closely resemble Russia’s S-300 platform.

The composition of Chinese arms imports is also changing. Whereas in the past China procured entire weapons systems, it is increasingly purchasing specific components that can be outfitted on platforms designed and built at home. Of particular note is China’s longstanding need to acquire foreign engines to compensate for its struggles to indigenously produce them. Between 2011 and 2020, China ordered almost 1,000 aircraft engines from Russia – a nearly fourfold increase over the previous decade. During the same period, China only ordered 95 aircraft from Russia, marking a 62 percent decrease from the 2001-2010 total.

| Chinese Orders of Russian Combat Aircraft and Engines | |||

|---|---|---|---|

| Type | Number Ordered (2001-2010) | Number Ordered (2011-2020) | Change |

| Combat Aircraft | 250 | 95 | -62% |

| Engines | 277 | 997 | +260% |

| Source: Stockholm International Peace Research Institute (SIPRI) | |||

Ukraine, which shares technological ties with Russia stemming from the Soviet era, also provides China with propulsion systems. In 2011, Beijing acquired 250 Ukrainian turbofans for trainer and combat aircraft, along with 50 diesel-powered tank engines and three refurbished IL-78 air-refueling planes. A sizable portion of China’s orders from France are for engines. China has sourced French-built diesel engines, such as the 16PC2.5 and 12PA6, for outfitting its naval vessels. There are also indications that China has acquired French civilian helicopter engines for military use.