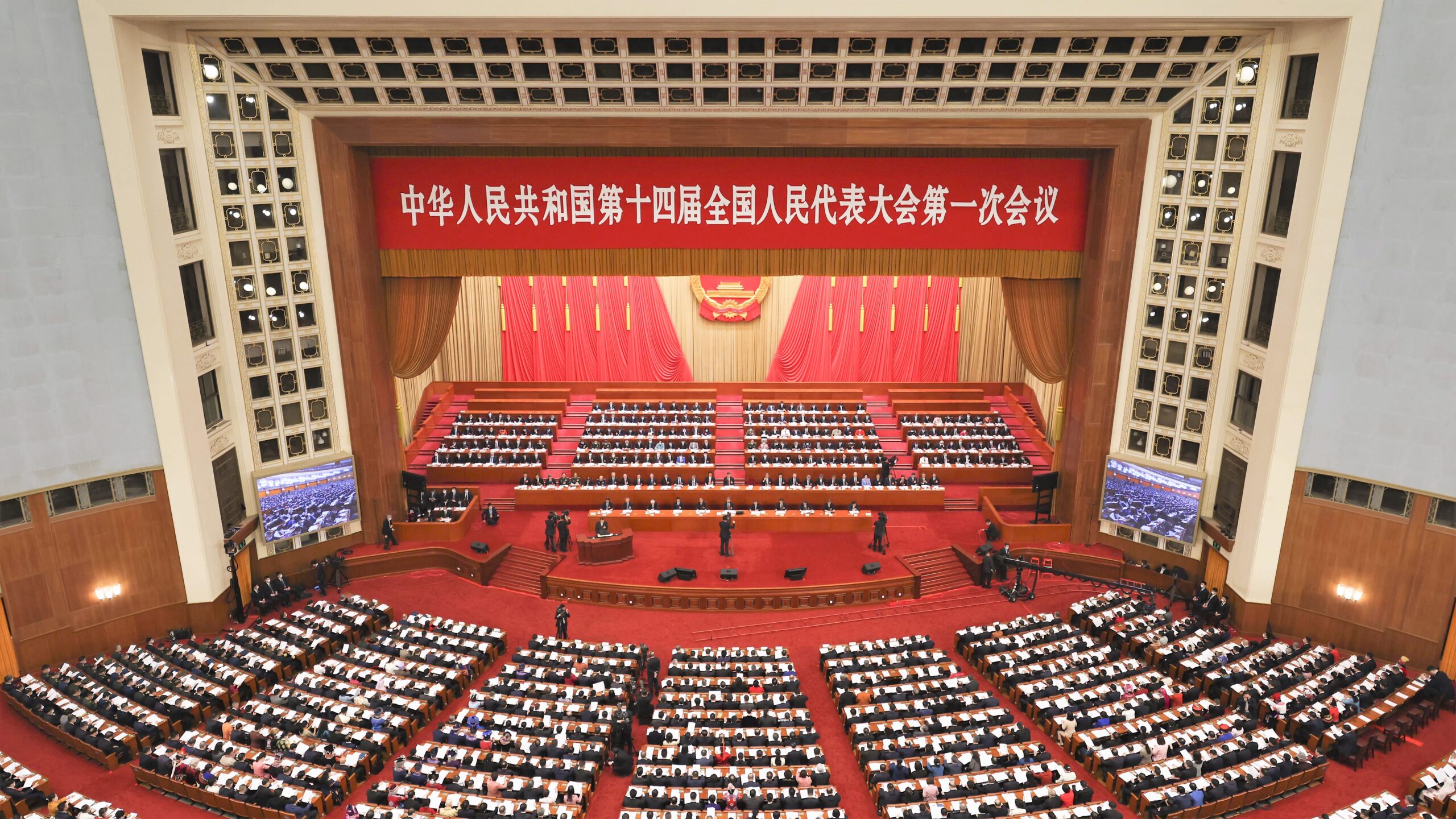

On this episode of the ChinaPower Podcast, we are joined by Nicholas Borst to discuss China’s debt situation and fiscal policy. He explains that China’s debt levels have increased dramatically relative to the size of the Chinese economy and China has more debt as a proportion of GDP compared to the United States. Much of the debt is concentrated in local governments, state-owned enterprises (SOEs), and real estate developers. Mr. Borst describes China’s decentralized fiscal system where the Chinese central government is fiscally conservative and local governments bear more risk and are responsible for healthcare, infrastructure, and social insurance as well as supporting key central initiatives such as the Belt and Road Initiative. Although no Chinese local government has defaulted to date, Chinese SOEs have defaulted, and their defaults have led to shocks to the Chinese market. Looking forward, Mr. Borst argues that the reforms passed at China’s recent “Two Sessions” will do little to address the root issues of China’s fiscal issues.

Keyword:fiscal policy

Making Sense of China’s Government Budget

Each spring, China releases a government budget report that provides valuable insights into the country’s spending priorities and overall fiscal health. Yet these budgets can be difficult to parse, and the topline figures only tell part of the story. This ChinaPower feature untangles the details behind China’s government budget.